MCA Filing FAQs for NBFCs: Latest Updates on Lot 3 Forms

This FAQ provides a comprehensive overview of the MCA’s Lot 3 form rollout under V3, with a focus on filing requirements for NBFCs, including AOC-4, CSR-2, and linked forms. It covers new forms introduced, filing sequences, offline utilities, and key compliance points for successful submission.

- What are the form IDs included in Lot 3?

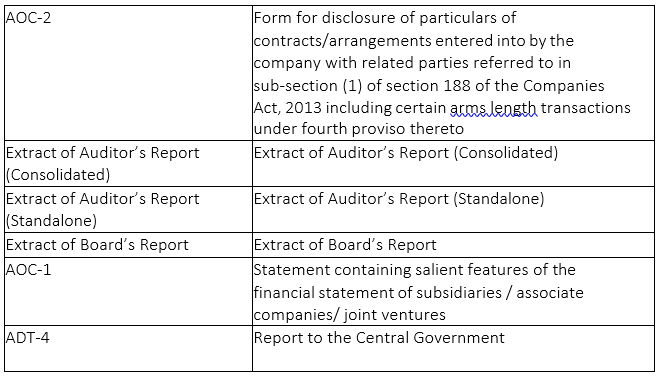

Forms covered in Lot 3 are:

| S. No. | Form ID | Form description | Processing Type |

| 1 | AOC-4 | Form for filing of financial statements and other documents with the Registrar | Conditional STP |

| 2 | Extract of Auditor’s Report (Consolidated) | Extract of Auditor’s Report (Consolidated) | Linked |

| 3 | Extract of Auditor’s Report (Standalone) | Extract of Auditor’s Report (Standalone) | Linked |

| 4 | Extract of Board’s Report | Extract of Board’s Report | Linked |

| 5 | AOC-1 | Statement containing salient features of the financial statement of subsidiaries / associate companies/ joint ventures | Linked |

| 6 | AOC-2 | Form for disclosure of particulars of contracts/arrangements entered into by the company with related parties referred to in sub-section (1) of section 188 of the Companies Act, 2013 including certain arms length transactions under fourth proviso thereto | Linked |

| 7 | AOC-4 NBFC (Ind AS) | Form for filing financial statement and other documents with the Registrar | Conditional STP |

| 8 | AOC-4 CFS NBFC (Ind AS) | Form for filing consolidated financial statements and other documents with the Registrar | Linked/Conditional STP |

| 9 | AOC-4 CFS | Form for filing consolidated financial statement with the Registrar | Linked/Conditional STP |

| 10 | AOC-4 Addendum/CSR-2 | Report on Corporate Social Responsibility (CSR) | Linked/ STP |

| 11 | AOC-4(XBRL) | Form for filing XBRL document in respect financial statement and other documents with the Registrar | Conditional STP |

| 12 | MGT-7 | Annual Return (other than OPCs and Small Companies) | STP |

| S. No. | Form ID | Form description | Processing Type |

| 13 | MGT-7A | Abridged Annual Return for OPCs and Small Companies | STP |

| 14 | MGT-15 | Report of Annual General Meeting | STP |

| 15 | ADT-1 | Notice to the Registrar by company for appointment of auditor | STP |

| 16 | ADT-2 | Application for removal of auditor(s) from his/their office before expiry of term | Non-STP |

| 17 | ADT-3 | Notice of Resignation by the Auditor | STP |

| 18 | ADT-4 | Report to the Central Government | Non-STP |

| 19 | GNL-1 | Form for filing an application with Registrar of Companies | Non-STP |

| 20 | INC-22A | ACTIVE (Active Company Tagging Identities and Verification) | STP |

| 21 | CSR-1 | Registration of Entities for undertaking CSR Activities | STP |

| 22 | CRA-2 | Form for intimation of appointment of cost auditor by the company to Central Government | STP |

| 23 | CRA-4 | Form for filing Cost Audit Report with the Central Government | STP |

| 24 | CRL-1 | Return regarding number of layers | STP |

| 25 | LEAP-1 | Form for submission of Prospectus with the Registrar | STP |

| 26 | Complaint form | Investor complaint form | Non-STP |

| 27 | 23C | Form of application to the Central Government for appointment of cost auditor | Conditional STP |

| 28 | 23D | Intimation by cost auditor to Central Government | STP |

| 29 | 23B | Information by auditor to Registrar | STP |

| 30 | I-XBRL | Form for filing XBRL document in respect of cost audit report and other documents with the Central Government | STP |

| 31 | A-XBRL | Form for filing XBRL document in respect of compliance report and other documents with the Central Government | STP |

| 32 | 20B | Form for filing Annual return by a company having a share capital with the Registrar | STP |

| 33 | 21A | Particular of Annual return for the company not having share capital | STP |

| S. No. | Form ID | Form description | Processing Type |

| 34 | 23AC | Form for filing balance sheet and other documents with the Registrar | STP |

| 35 | 23ACA | Form for filing Profit and Loss account and other documents with the Registrar | STP |

| 36 | 23AC-XBRL | Form for filing XBRL document in respect of balance sheet and other documents with the Registrar | STP |

| 37 | 23ACA-XBRL | Form for filing XBRL document in respect of Profit and Loss account and other documents with the Registrar | STP |

| 38 | 66 | Form for submission of Compliance Certificate with the Registrar | STP |

- Are there any new forms rolled-out as part of Lot 3 forms launch?

Yes. Below are 6 new forms that got rollout in V3 as new webforms which were not available in V2.

Note: Except Form No. ADT-4, all other new forms must be filed as linked filing to AOC-4/AOC- NBFC (Ind AS) /AOC-4 CFS/AOC-4 CFS NBFC (Ind AS) as per the applicability mentioned in the linked filing matrix FAQ

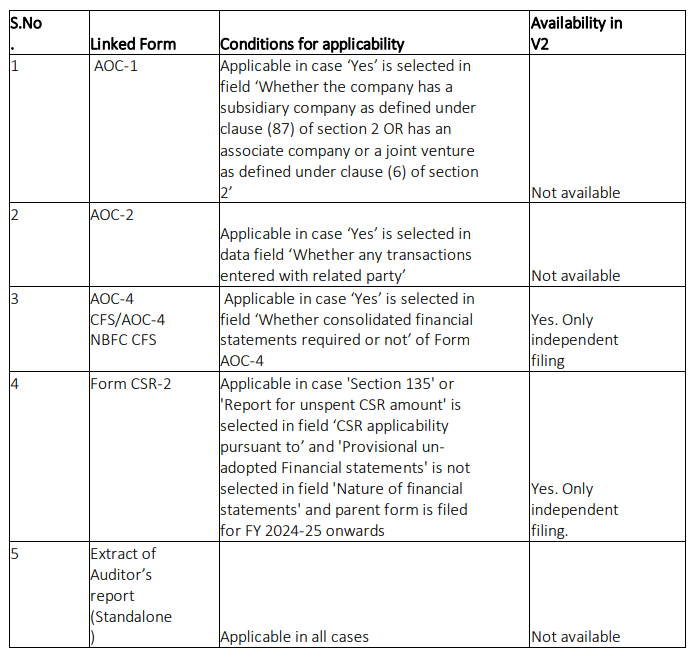

- What is the applicability of linked filings?

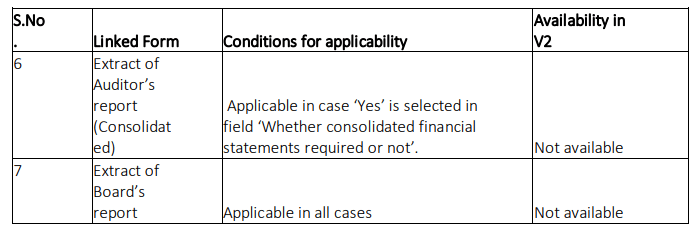

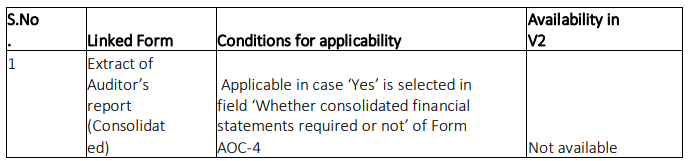

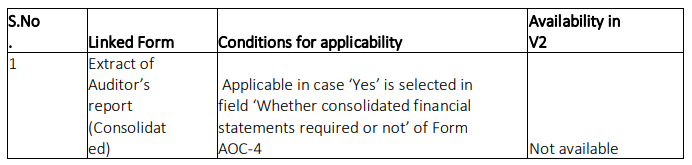

- AOC-4/AOC-4 NBFC (Ind AS)

- AOC-4 XBRL

- AOC-4 CFS

- AOC-4 CFS NBFC (Ind AS)

- What is the sequence of linked forms filing to AOC-4/AOC-4 NBFC?

Below is the sequence of filing of linked filings to AOC-4/AOC-4 NBFC:

- AOC-4-CFS/AOC-NBFC CFS [If applicable]

- AOC-1 [If applicable]

- AOC-2 [if applicable]

- CSR-2 [if applicable]

- Extract of Auditor’s report (Standalone) [Mandatory for all cases]

- Extract of Auditor’s report (Consolidated) [if applicable

- Extract of Board’s report [Mandatory for all cases]

- Attachment ‘Directors’ report as per sub-section (3) of section 134’ got removed in AOC-4, AOC-4 CFS, AOC-4 NBFC and AOC-4 NBFC CFS. Is it required to include ‘Boards report’ while attaching ‘Financial Statements’ to these forms?

Yes. Copy of financial statements duly authenticated as per section 134 (including Board‘s report, auditors‘ report and other documents) to be attached mandatorily while filing AOC-4, AOC-4 CFS, AOC-4 NBFC and AOC-4 NBFC CFS.

Also, above mentioned attachment is required to be attached while filing AOC-4 XBRL in addition to XBRL financial statements.

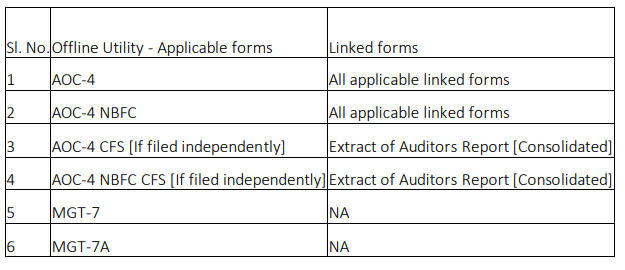

- Which forms can be filed in Offline mode?

Below mentioned forms can be filed either in Online or Offline mode:

- What are the key points to be considered while filing AOC-4/AOC-4 NBFC?

The following points need to be considered:

- The company for which the form is filed shall have a valid and active/Under CIRP/Under Liquidation CIN.

- The DSC attached in the form is registered on MCA portal against the DIN/PAN/Membership number as provided in the form.

- The applicant of the form is registered as Business User at the MCA portal before filing the webform.

- The signing authority of the form shall have valid and non-expired/non-revoked DSC.

- The authorized signatories of the company shall have an approved DIN or valid PAN or valid membership number as applicable.

- The company is not flagged for the filing of Form No. INC-22.

- The company has not already filed another Form AOC-4 which is either pending for payment or pending for approval in respect of the same financial year end date.

- The CIN status should not be strike off, Amalgamated, Converted to LLP, Converted to LLP and Dissolved, Dormant under Sec 455, Dissolved, Liquidated, not available for e-Filing, under process of Strike off, under liquidation, dissolved under section 59(8) of Insolvency and Bankruptcy Code, 2016 and Dissolved under section 54 of Insolvency and Bankruptcy Code, 2016.

- The Membership number or certificate of practice number of the practicing professional is valid for the particular category of the professional (including respective associate/fellow flag) signing the e-form.

- There is no overlap in the period (Financial year start date and end date) entered in any other approved annual filing which has not being marked as defective.

- SRNs of ADT-1/INC-28/AOC-4/MGT-14/GNL-1 [wherever applicable] entered in the form are approved and associated with the Company.

- Purpose of the SRN entered for form AOC-4 must be ‘Provisional un-adopted statements’ if purpose selected in current form AOC-4 is ‘Adopted financial statements’ and ‘Yes’ selected in field 4(b)(iv)‘Whether adopted in adjourned AGM’.

- ‘Provisional un-adopted financial statement’ or ‘adopted financial statement’ cannot be filed in case form AOC-4 is already approved for same purpose and for the same financial year end date. Please ensure that the date of AGM, due date of AGM and extended due date of AGM (if any) are same as specified in other approved annual filing e-Form MGT- 7/MGT-7A/ AOC-4 filed for the same financial year end date. However, in case the date of AGM was not filled in earlier filed form AOC-4 with purpose ‘Provisional un-adopted

financial statements’ then date of AGM in current form AOC-4 being filed for the purpose

‘Adopted financial statements’ shall be allowed with the date of AGM. - This form will not be applicable for the type of companies notified under Companies (Filing of documents and forms in Extensible Business Reporting Language) Rules, 2015 for filing under XBRL format where type of Industry is ‘C&I’.

- That FY start date and end date should fall between Period from and Period To entered in field no. 4(i) of Form ADT-1.

- To enter valid membership number in auditors’ section.

- Standalone AOC 4/AOC-4 NBFC is submitted on V2. Whether the company is required to cancel this form and file fresh form as CFS form is linked form in V3? Is there any option available in V3 to file AOC-4 CFS/AOC-4 NBFC CFS independently?

No the Companies are not required to cancel the Standalone AOC 4/AOC-4 NBFC SRN to file CSR-2 form.

AOC-4 CFS/AOC-4 NBFC CFS can be filed independently only for those SRNs for which AOC-4/AOC-4 NBFC were filed in V2. For all the prospective filings, it will be mandatorily filed as a linked form with AOC-4/AOC-4 NBFC.

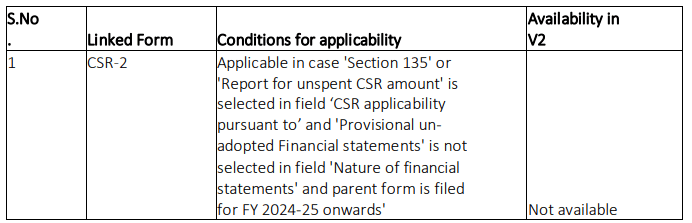

- Whether CSR-2 is required to be filed separately or independently?

Independent filing of CSR-2 is allowed only for the FY 2020-21, 2021-22, 2022-23, 2023-24 and FY 2024- 25[already filed in V2] which are required to report CSR as per relevant rules.

From Financial year 2024-25 onwards in V3, form to be filed as linked filing with AOC-4/AOC-4 NBFC/AOC-4 XBRL based on the applicability mentioned FAQ no. 9.

- Are there any file size limit exceptions for Annual filing forms?

- ‘List of shareholders, debenture holders’ excel attachment size limit is increased to 300 MB in MGT-7 [15 files of 20 MB each]. Generated PDF will not have List of shareholders, debenture holders excel as an attachment. However, data uploaded in these excels will be stored in the system.

- 2 MB limit of each attachment is removed in the following forms. Attachments can be uploaded beyond 2 MB subject to overall form size limit including all attachments is 10 MB.

- AOC-4

- AOC-4 XBRL

- AOC-4 NBFC

- AOC-4 CFS

- AOC-4 NBFC CFS

- All other forms attachments and form size limit would continue as the normal process i.e. each attachment size is restricted to 2 MB and the overall form size including all attachments is 10 MB.

- I have filed Form AOC-4, AOC-4 NBFC where class wise master is not getting captured in the form or Form AOC-4 XBRL IND-AS where total paid-up capital is showing only Equity portion. Will my paid-up capital get updated in the system?

The update of Paid-up capital through Forms AOC-4/AOC-4 XBRL/AOC-4 NBFC is restricted in V3 system and it will only be updated through Form MGT-7/MGT-7A.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement.